Global Market Figures and Trends

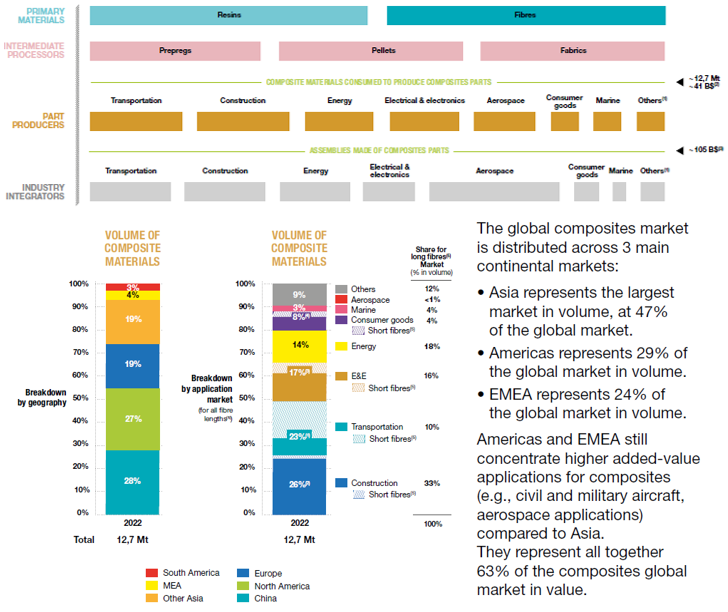

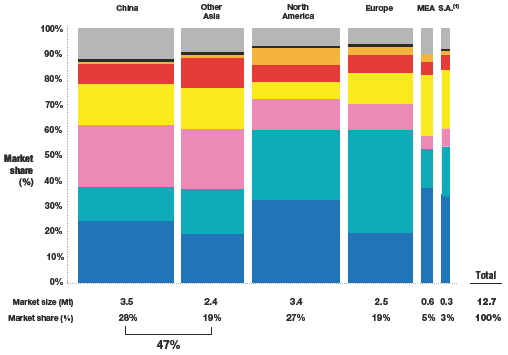

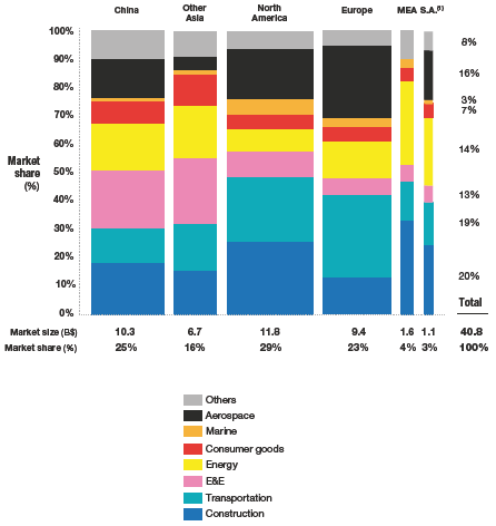

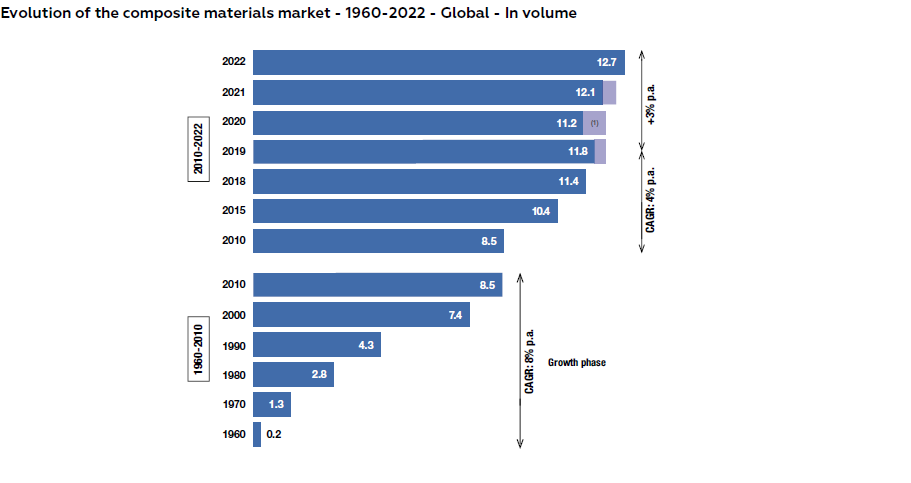

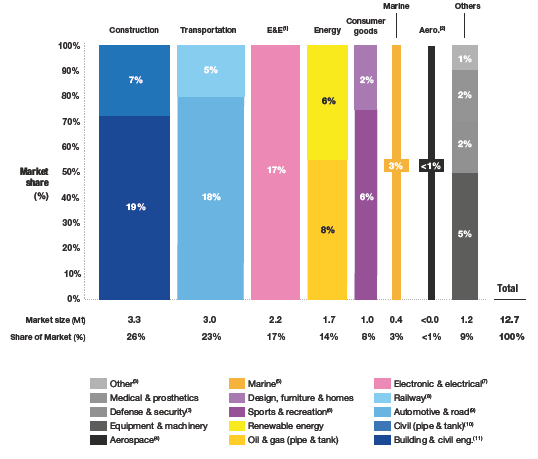

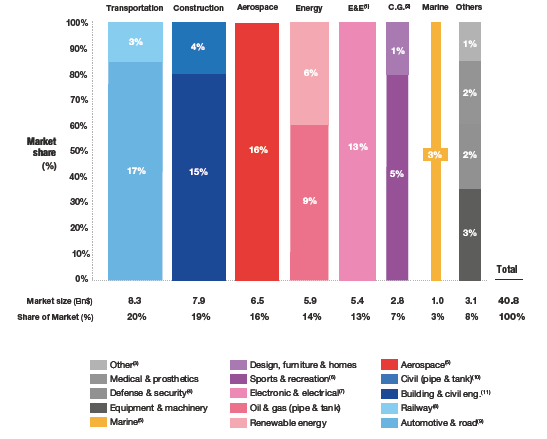

At the end of 2022, the market is estimated at 12.7 Mt worldwide (composite materials that are consumed to produce composite parts). It represents in value a market of 41 B$ of composite materials and corresponds to a market of assemblies that are made of composites parts worth 105 B$.

The composites market in 2022 is quantified at the level of composite materials and composite parts, as well as the proportions of different regions and fields

The booming Chinese Market Ignites Asia's prosperity, with construction sector accounting for approximately 1/5 market share-2022

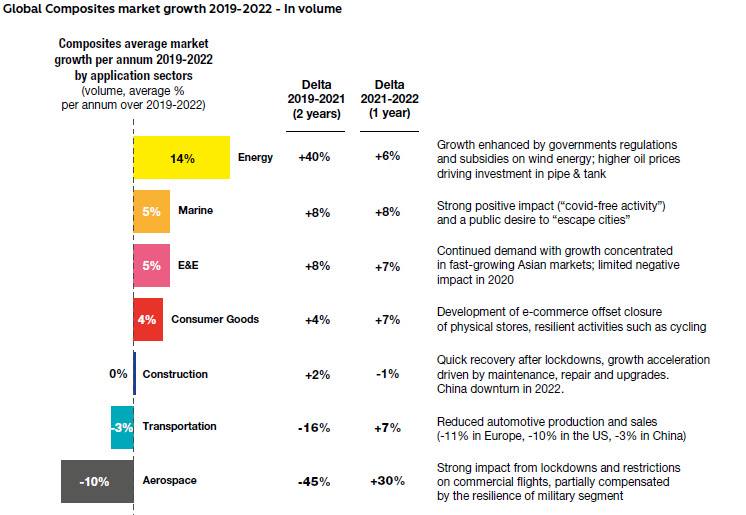

Following the pandemic, the global composites industry has rebounded in 2022

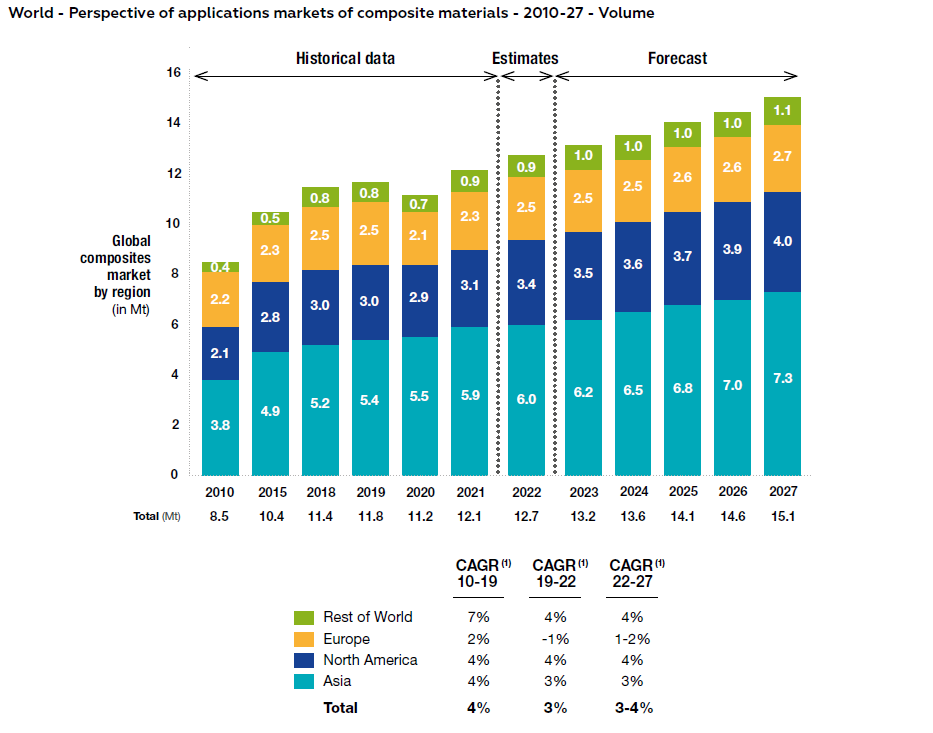

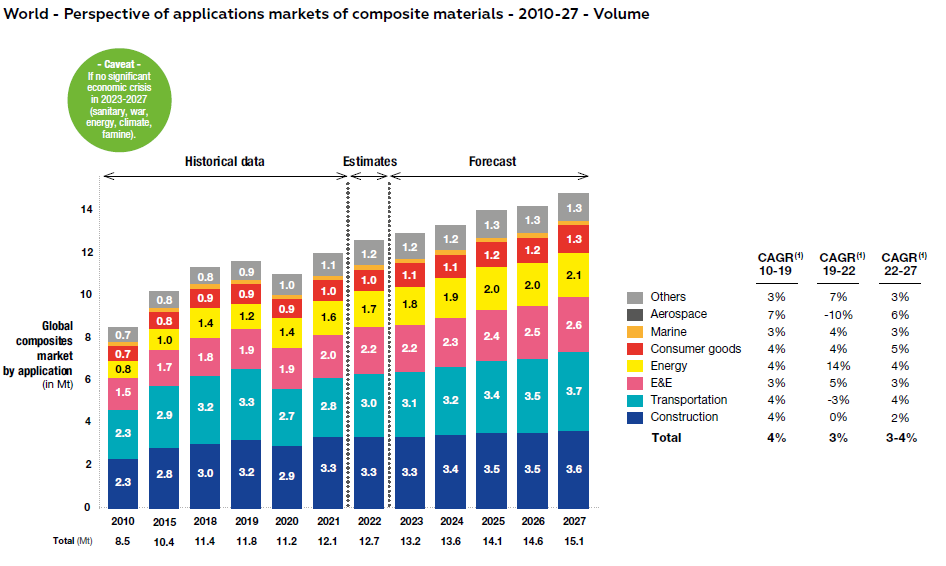

In the future, the composite materials market should resume its long-term trend

In the future, it is expected that the future growth of composites materials should be differentiated by geographies.

• Asia is likely to grow at a faster rate than other continents, at ~4% p.a.

• North American growth is forecast at around 3-4% p.a.

• European growth could be lower, at 1% or 2% p.a.

Since 2010 Asia has enjoyed strong growth rates in composite materials, which has mainly been driven by China, growing at 8% p.a. from 2010 to 2019 and now representing 59% of the Asian market in volume. Despite a slowdown of its economic growth rate, China should continue to be a strong driver of the global composites industry.

Construction: A Resilient Market

In value the composites market for construction makes up 19% of the global composites market in 2022 (26% in volume). The construction sector was strongly hit in 2020 by the Covid-19 pandemic, however, it quickly recovered to structural levels.

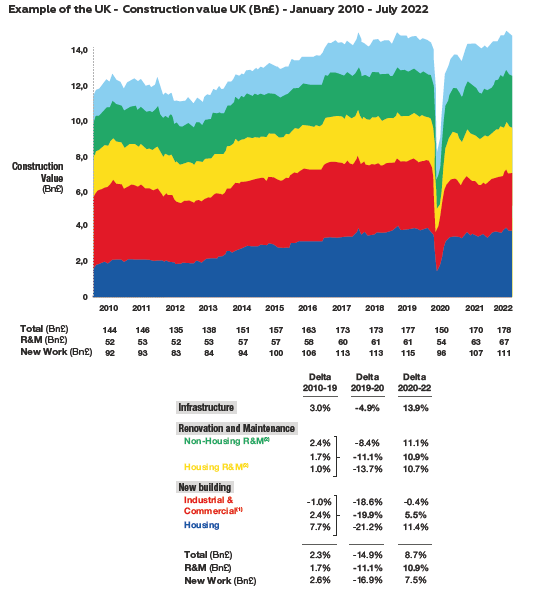

In 2022, the construction sector of composite materials, strongly hit by the Covid-19 pandemic, has recovered

In 2022, the construction sector of composite materials, mainly driven by Civil(pipe & tank) , Building & Civil engineering

In construction, infrastructure and renovation/maintenance are more resilient than new building

In the future, composites for construction sector have room to grow as they still represent a limited share of the total used materials (mainly concrete, steel, wood). Applications such as composite rebars have further potential as they should become increasingly used in buildings and infrastructure.

The construction segment for composites is consequently expected to grow at a limited 2% per year on average in the next 5 years, provided no major crises happen in the meantime. During economic crises, infrastructure, as well as renovation or maintenance, are more resilient market drivers than new buildings.

In the future, the composite materials market for construction sector should resume its long-term trend

The price of composites projects, while far more expensive, has become more competitive as the prices of steel, concrete and timber have been rising. In addition, being far lighter and subsequently requiring less groundwork make composite structures friendlier to the environment, thereby reducing the cost associated with labour and plant (machinery) hired for an equivalent project.

Poor durability of infrastructure facilities is likely to attract growing investments in the United States, thus possibly driving the composite market. Fiber Reinforced Polymers (FRP) rebars are light in weight and exhibit high tensile strength, especially because of the higher lifespan , having the potential to replace the steel rebars.

At the European level, water networks in Italy and Eastern Europe (Italy, Bulgaria, Romania) represent a significant opportunity for composite pipe manufacturers in the coming years. Leakage rates from these networks, which range in length from 70000 km (Bulgaria) to 480000 km (Italy), vary between 40% (Italy) and 60% (Bulgaria). Therefore, significant restoration work could be required over the coming years.